Quick Summary

Credit unions face challenges and opportunities in the post-pandemic era, especially in debt collections. Debt collections are vital for the financial health and customer loyalty of credit unions, but traditional methods are often inefficient, ineffective, and impersonal.

Therefore, adopting intelligent & automated debt recovery solutions for credit unions with artificial intelligence (AI) and machine learning (ML) can be recommended.

Automated debt collections can help credit unions improve their debt recovery outcomes, reduce their operational expenses, and enhance their customer relationships.

This article provides a 4-point guide for successful automated debt collections for credit unions in 2024. The guide covers the following points:

- Adopt a customer-centric approach: Personalising communication and engagement with customers using AI and ML, and respect their privacy, consent, and preferences.

- Invest in the right technology and talent: Choosing and implementing the best automated debt collection solutions powered by AI and ML, and train and upskill their staff and partners on the use and benefits of automated debt collections.

- Optimise the debt collection process: Streamlining debt collection workflows and tasks using AI and ML, and comply with the relevant laws and regulations.

- Leverage the power of data and analytics: Harnessing the power of data and analytics to enhance decision-making and strategy using AI and ML, and ensure the quality, accuracy, and security of data and analytics.

Let’s move to the detailed breakdown.

Point 1: Adopt A Customer-Centric Approach

Credit unions should treat their customers as individuals, not as numbers. The tactical execution includes tailoring their communication and engagement strategies to their specific needs, preferences, and feedback.

Within the context, automated debt collections can help credit unions personalise their communication and engagement with customers using AI and ML.

- For example, AI and ML can enable credit unions to segment customers based on their risk profile, behaviour, preferences, and feedback, and deliver customised messages and offers through the most appropriate channels and times.

AI and ML can also help credit unions to monitor the effectiveness of their engagement strategies, and adjust them accordingly to improve customer response and satisfaction.

Scott Cook explained it best when he said, “Instead of focusing on the competition, focus on the customer.”

Point 2: Invest In The Right Technology And Talent

Well-timed choosing and implementing technologically superior automated debt collection solutions is the next second point. However, mere implementation isn’t enough; sustainable training and upskilling of staff are as important.

To fulfil these two objectives successfully, Affiniti Collect Plus is a strong candidate and is a great example to dissect the second point of this guide.

Affiniti Collect Plus is our award-winning collections and recovery solution being used by leading financial brands. Its capabilities align with the best interests of a credit union, including AI/ML-powered automation.

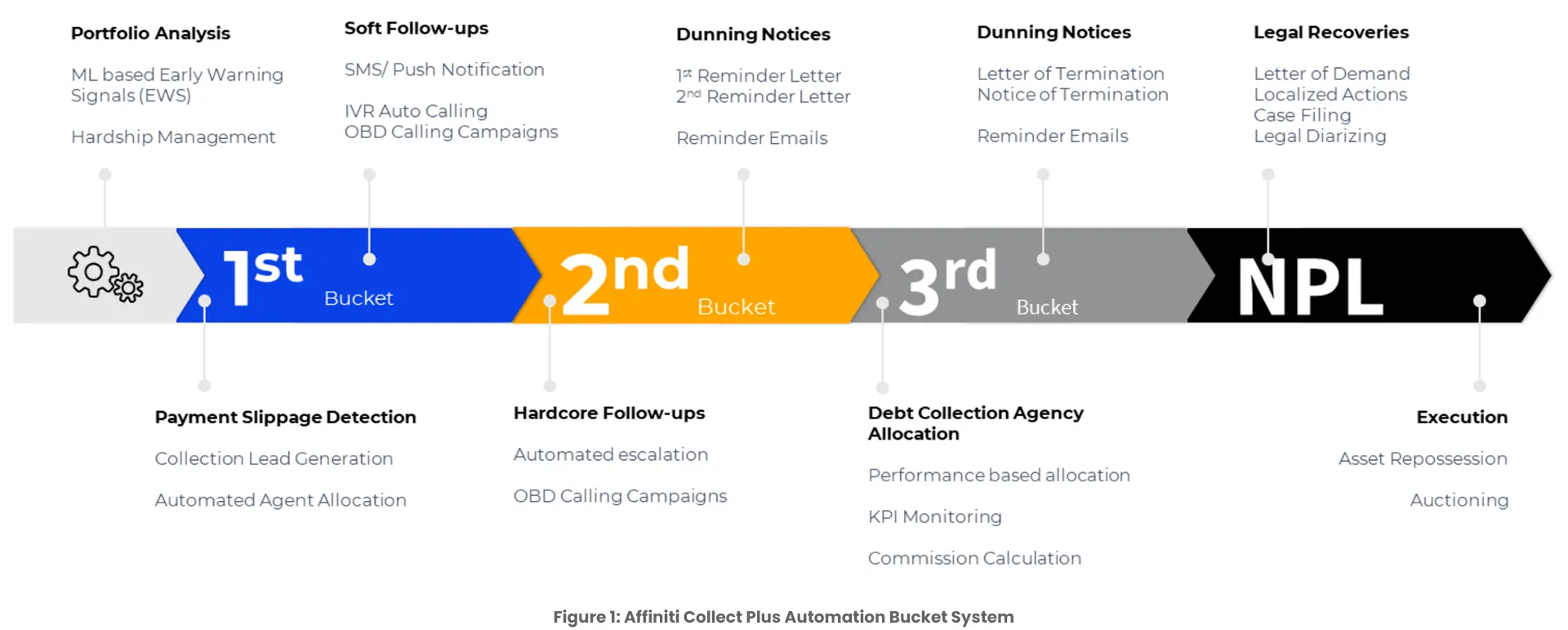

Being one of the handful of debt recovery platforms with legal case management capability, Affiniti Collect Plus’ AI/ML-powered automation works based on an age-bucket system. This is a snapshot of how the platform behaves with time:

- 0th bucket (early warning system)

- 1st bucket: IVR auto calling and push notifications, following automated agent allocation

- 2nd bucket: Automated escalations including reminder letters and emails

- 3rd bucket: Possible debt collection agency allocation, finishing the termination stage

- NPL: Legal case management

This bucket system sets a benchmark for automated debt recovery and is powered by a resilient modular architecture that supercharges a credit union across multiple aspects.

We also understand that credit unions typically have to pay for product training. However, at Affiniti, we do it for free. Additionally, the platform is highly user-friendly and makes it fun to use.

In conclusion, by investing in the right technology and talent, credit unions can ensure the success and sustainability of their automated debt collections. Affiniti Collect Plus is a prime example within the context.

If you’re interested in seeing Affiniti Collect Plus live-in-action, feel free to contact us at sales@affiniti.biz

Point 3: Optimise The Debt Collection Process

Process innovation is the key here that eliminate any unnecessary or redundant steps, costs, or errors. Automated debt collections enable credit unions to optimise the debt collection process using AI and ML.

- For example, AI and ML can enable credit unions to monitor and analyse customer data, such as payment history, credit score, income, expenses, and life events. Then, they can use them to predict customer behaviour, such as propensity to pay, willingness to negotiate, or likelihood to default.

However, credit unions should also avoid any practices that may harm or harass their customers, such as excessive or inappropriate contact, which typically happens due to a lack of interaction history visibility.

By optimising the debt collection process, Credit unions can save time, money, and resources by automating and optimising their debt collection workflows and tasks, and focus on their core competencies and value propositions.

Point 4: Leverage The Power Of Data And Analytics

The fourth and final point of the guide is to leverage the power of data and analytics to enhance their decision-making and strategy.

This is about harnessing the power of data and analytics to gain a deeper and broader understanding of their customers, their debt collection performance, and their debt collection environment, and use them to formulate and execute their debt collection strategies and tactics.

- AI and ML can enable credit unions to collect and integrate data from various sources, such as internal systems, external databases, social media, and customer feedback, and use them to create a comprehensive and holistic view of their customers and their debt situations.

AI and ML can also help credit unions apply advanced analytical techniques, such as descriptive, diagnostic, predictive, and prescriptive analytics, to their data. The benefit of that is to generate valuable insights and foresight that can inform and guide their debt collection decisions and actions.

It should be a priority to protect their data and analytics from unauthorised access, use, or disclosure and that they report and respond to any data breaches or incidents promptly and appropriately.

Conclusion

Automated debt collections are not a futuristic or hypothetical concept, but a realistic and practical solution for credit unions in the post-pandemic era. Automated debt collections can help credit unions to gain a strategic and competitive advantage in the debt collection industry, and to fulfill their mission and vision of serving their customers and communities. This 4-point guide is a recommendable starting point in your future journey with automation.

We look forward to seeing you in Affiniti Perspectives again.